April Resource of the Month: Tax Notes

April 15. Tax Day. What better day to take a look at April’s resource of the month, Tax Notes? Tax Notes “is a portfolio of publications offered by Tax Analysts, a nonprofit tax publisher.” This portfolio includes federal, state, and international news, analysis and commentary by impartial, nonpartisan tax experts.

Fun facts about Tax Analysts

Tax Analysts, the publishers of Tax Notes, was founded in 1970 “to foster free, open, and informed discussion about taxation” and remains committed to ensuring tax policymakers are transparent. In 1972, Tax Analysts, sued the IRS to force public access to private letter rulings (PLRs) and technical advice memoranda (TAMs) because the IRS uses these documents to provide legal advice to specific taxpayers and IRS field agents. Tax Analysts won access to the PLRs through their suit, and Congress shortly thereafter required the IRS to publicly disclose its TAMs. Tax Analysts has also used the Freedom of Information Act to force the IRS and state revenue agencies to publicly disclose information they have provided in private decisions.

What is Tax Notes?

Tax Notes is a suite of publications and resources providing daily news, analysis, and commentary on tax matters. The publications on Tax Notes include

- Tax Notes Federal a weekly journal featuring news, commentary, and analysis on federal taxation (the longest-running periodical from Tax Analysts)

- Tax Notes International, a weekly magazine focused on international tax

- Tax Notes State in 1991.

These weekly journals, which offer tax commentary and analysis on changes in tax law and policy, on court opinions and legislative action and revenue rulings,

Tax Notes also has the daily news services Tax Notes Today Federal, Tax Notes Today International and Tax Notes Today State. In addition to these publications, Tax Notes provides research and reference tools as well as specialized services focusing on international tax treaties, exempt organizations, and state tax audit guidance.

How do I access Tax Notes?

You can access Tax Notes through D’Angelo Law Library’s A-Z List of Databases; you will be required to create an account while on campus or signed in to the cVPN, using a UChicago email address. Once you have an account set up, you will be able to sign in directly to the platform.

How do I use Tax Notes?

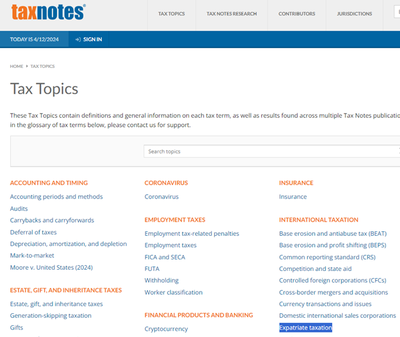

Tax Notes users can begin their research one of several ways: by “Tax Topic;” in the “Tax Notes Research” tab; by contributing author; by jurisdiction; by a simple keyword search; by an advanced search; or by exploring the “What’s New,” “Free Resources,” or “Subscriptions” tabs.

If you select a topic, such as “Expatriate taxation” under the heading “International taxation,” the platform will show you a results page with robust filters, a selection of related topics, a section where you can click to learn more about your selected topic, and a list of results from Tax Notes’ array of publications. A topic search is one of the broadest you can do on the platform; if you wanted to use the filters to narrow your results to a particular sub-topic, jurisdiction, or publication, you could do that. You can also create alerts and save searches.

Under the research tab, you can directly search state and federal codes, regulations, proposed rules, rulings, private rulings and advice, archives, manuals, reference tables, legislative documents, guidance, circulars, Treasury decisions, public comments, final and temporary regulations, and court documents.

For in-depth assistance on how to use Tax Notes, see the Help Center. The Help Center provides video tutorials, user guides, webinars, research guides, and FAQs. The Help Center also provides a section showing the site’s coverage, so you can see how far back the various publications within your subscription go (for example, if your subscription includes one or more weekly magazine publications, individual articles from Tax Notes Federal will go back to the initial publication date of 9/18/1972 and full issues will go back to 1/5/1998). It will also tell you which research tools require separate subscriptions.

If you have questions, please don't hesitate to Ask a Law Librarian!